Photography by Getty Images

Key takeaways

- FICO and VantageScore credit scores span from 300 to 850. The higher your score, the more likely you are to secure loans, credit cards and financing options with better terms and lower interest rates.

- Different factors are considered when calculating your credit score, including your payment history, amounts owed, length of credit history, new credit accounts and credit mix.

- You can raise your credit score by following best practices, including paying your bills on time, paying off outstanding debts and keeping your credit utilization ratio low.

Your credit score is one of the most crucial indicators of your financial health. Having a higher score can help you achieve your financial goals, access lower interest rates when borrowing money and even qualify for lower insurance rates.

But building good credit can be a challenge, especially when financial emergencies arise. A quarter of U.S. adults (25 percent) say they would deal with a major unexpected expense — such as an emergency room visit or major car repair — by financing it with a credit card and paying it off over time, according to Bankrate’s 2025 Annual Emergency Savings Report.

That said, many people are unaware of what influences their score or how to improve it. Here’s a breakdown of what makes up your credit score and the key steps for boosting your credit health.

How credit scores work

Your credit score is a three-digit number representing your credit health. It is designed to help lenders assess risk — specifically, the likelihood that you’ll become delinquent on your credit obligations in the next 24 months.

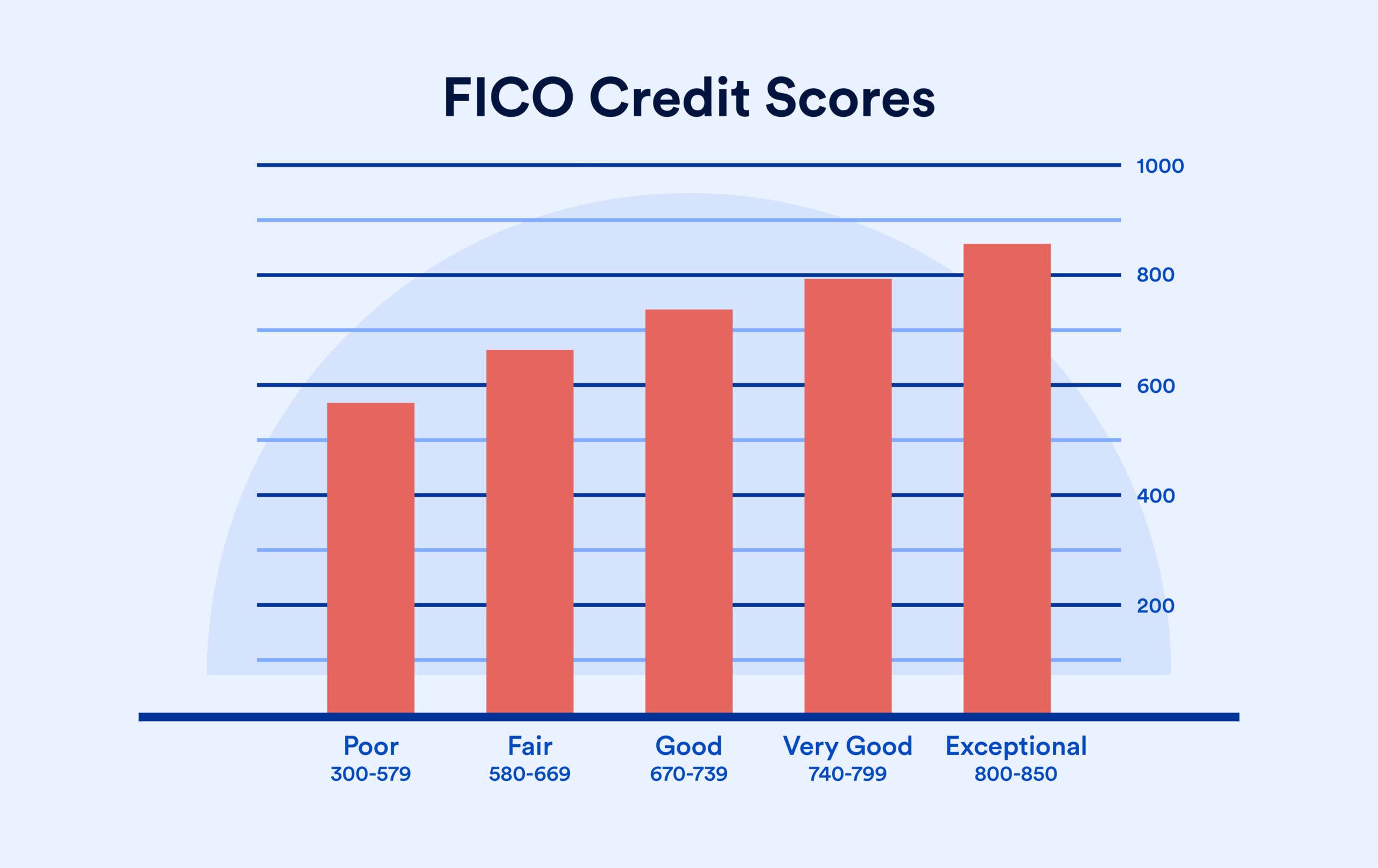

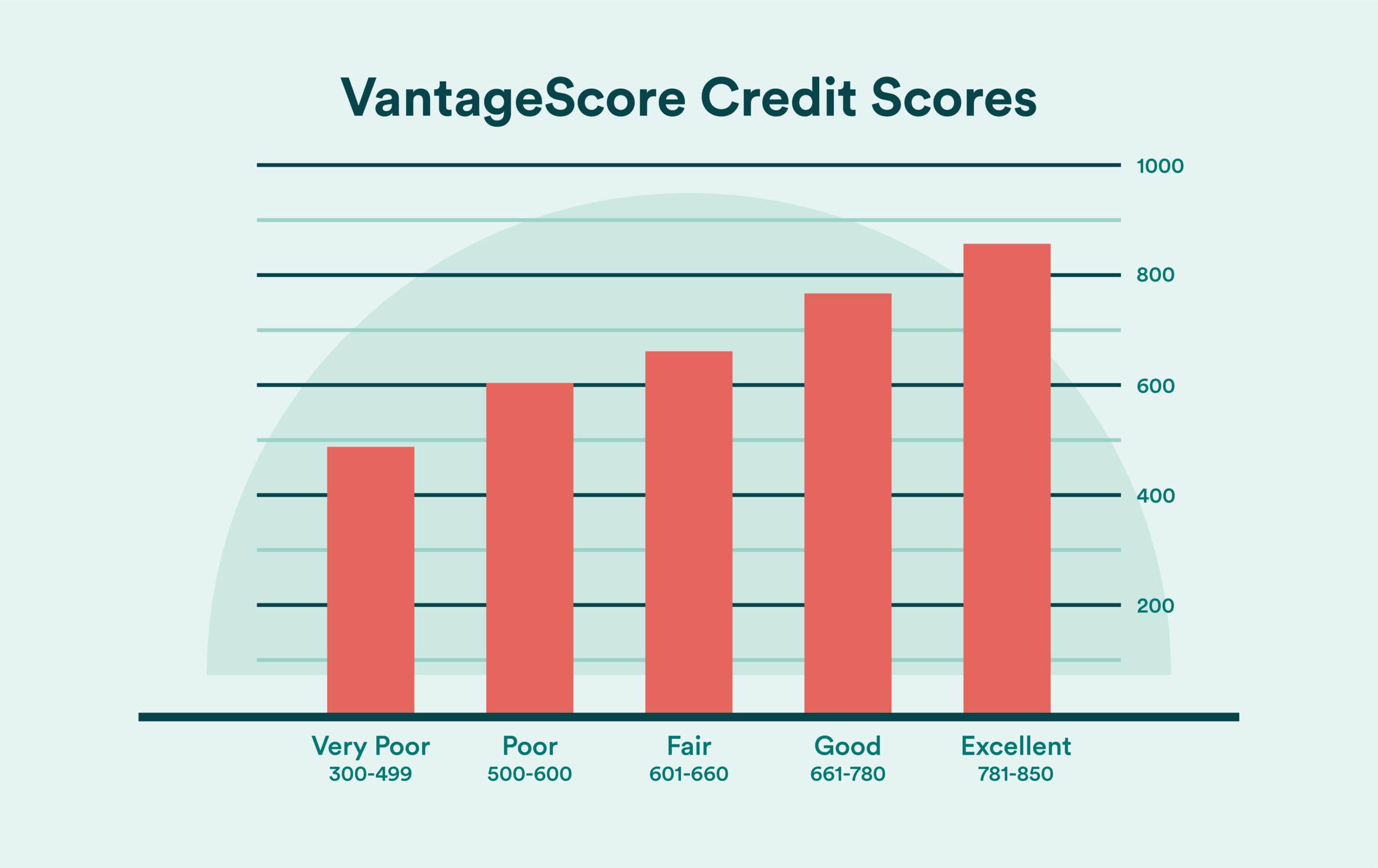

Many different credit scoring models exist, but the FICO credit score is the most popular and widely used. More than 90 percent of top lenders rely on the FICO Score to help them determine consumer eligibility for their financial products. Another popular scoring model you may have heard of is the VantageScore.

You’ll have a separate credit score for each of the three credit bureaus — Experian, Equifax and TransUnion — which assign you a score based on their internal processes and the way they process information on your credit account history, credit inquiries you’ve made, public records and other personal data.

“Equifax, TransUnion and Experian each calculate scores for you when requested by lenders or consumers, and your credit scores can fluctuate daily based on your credit activity,” notes Andrew Lokenauth, owner of TheFinanceNewsletter.com, which offers insights on personal finance.

What affects your credit score?

Whether you pay your bills on time and how much debt you have play the biggest role in determining your credit score. But how much new credit you have and how long you’ve had certain accounts can also have a substantial impact.

However, mistakes on your credit report can also impact your score — and not in a good way. Since different information is reported in your credit reports, and since your credit report can be different with each credit bureau, you should check your credit report for accuracy at least a few times a year at AnnualCreditReport.com, which allows you to request free reports every week.

Knowing how the credit bureaus calculate your credit score can help you determine how to best improve your credit over time. Each of the credit bureaus considers the following factors when determining your FICO Score:

VantageScore 3.0 vs. 4.0

Some card issuers and lenders use VantageScore models, rather than FICO, to determine a credit score. Different VantageScore models exist, but although both focus on payment history, depth of credit and utilization, there are slight differences between the two:

| VantageScore factor | VantageScore 3.01 | VantageScore 4.02 | Weight factor |

|---|---|---|---|

| Payment history | 40% | 41% | Paying your bills on time is key. If you don’t, your credit score will take a hit. |

| Depth of credit | 21% | 20% | Have an assortment of credit cards and build up your history with them because issuers favor those with a good balance of both. |

| Credit Utilization | 20% | 20% | This is your available credit limit versus how much of it you’re using. A good rule of thumb is to keep your ratio under 30 percent to keep your credit score in the good range. |

| Balances | 11% | 6% | It’s always a good idea to pay off balances every month if you can. If you don’t, not only do you risk paying more interest, but your credit score could suffer. |

| Recent credit | 5% | 11% | Issuers look at the number of cards you apply for versus newly opened ones. Your credit score can be affected if it seems that you’re applying for too many cards. |

| Available credit | 3% | 2% | VantageScore checks all the credit you have open, because issuers want to see that you are using it responsibly. |

1 What is VantageScore 3.0?

2 What is VantageScore 4.0?

What is a good credit score?

Both FICO and VantageScore break credit scores into five primary ranges to assess creditworthiness. Here’s how the two scoring bodies differ in the ways they define each range:

FICO

EXPAND

VantageScore

EXPAND

If your score is lower than you expected, don’t fret. It takes time to build a higher credit score and, no matter your score, you can use financial tools to help you achieve your goals.

Tips for maintaining and improving your credit score

To keep your credit score in the best shape possible, use any credit you have responsibly and wisely.

- Pay your bills on time. Since your payment history is the most important factor that makes up your FICO Score and VantageScore, make sure you never pay your bills late. Set payments on autopay if you can, or turn on reminders that let you know when your bills are due.

- Keep your credit utilization at 30 percent or lower. Most experts suggest keeping your credit utilization at 30 percent or below for the best odds of boosting your score. On a basic level, this means carrying a balance of no more than $3,000 for every $10,000 in available credit you have.

- Don’t open a lot of new accounts at once. Because new credit can impact your score, try to avoid situations where you’re opening a lot of credit cards or other types of accounts at once.

- Keep old credit accounts open. Keep old accounts that are in good standing open — even if you’re not using them (unless the account has an annual fee you can’t offset with perks or rewards). These old accounts can help add depth to the average length of your credit history.

- Monitor your credit reports. It’s a good idea to regularly monitor your credit reports for accuracy. If you encounter errors on your credit reports, take the time to dispute them.

The bottom line

You have more power than you think when it comes to your credit score. Pay your bills early or on time, don’t max out your accounts and keep an eye on your credit reports for errors. By taking these steps and sticking with them, you should be on your way to better credit in no time.

Frequently asked questions

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here