The Consumer Financial Protection Bureau (CFPB) released its new Explore Credit Cards tool this week, intended to allow consumers to compare more than 500 credit cards based on “unbiased, comprehensive data.”

The launch of the new resource is one of a number of actions taken by the CFPB this year in the interest of protecting consumers and promoting competition in credit card markets, including releasing new research on the high interest rates associated with retail store cards and providing relevant law enforcement agencies with guidance on the ways in which credit card rewards programs may be breaking the law.

The specific benefits highlighted on the Explore Credit Cards landing page align with this intent, claiming to differentiate the tool from other comparison sites through:

- No paid advertising

- Transparent card interest rates, graded on a scale from “$” to “$$$”

- A larger-than-usual pool of card selections, including options from more than 150 companies

- Publicly-available, downloadable data (refreshed every six months, with current card selections based on data from Jun. 30, 2024)

But how well does the tool deliver on these promises? As a senior editor on Bankrate’s credit cards team, I’m all for new resources that help people make better financial decisions, so I was eager to take a closer look.

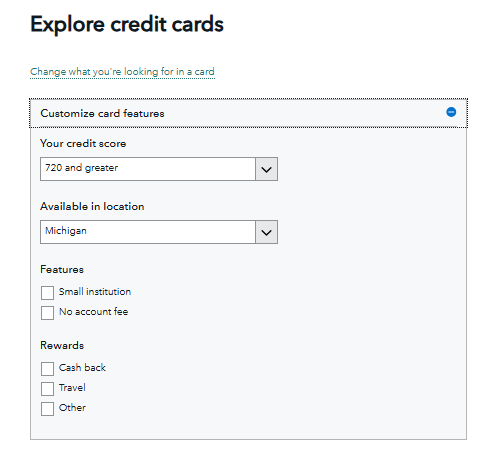

The tool itself lives on a CFPB landing page, where you’ll need to make three selections to see your card recommendations:

- Your credit score range (out of three options)

- Your state

- What you prioritize in a card, including low interest, balance transfers, large purchases, low fees, credit-building potential or rewards

EXPAND

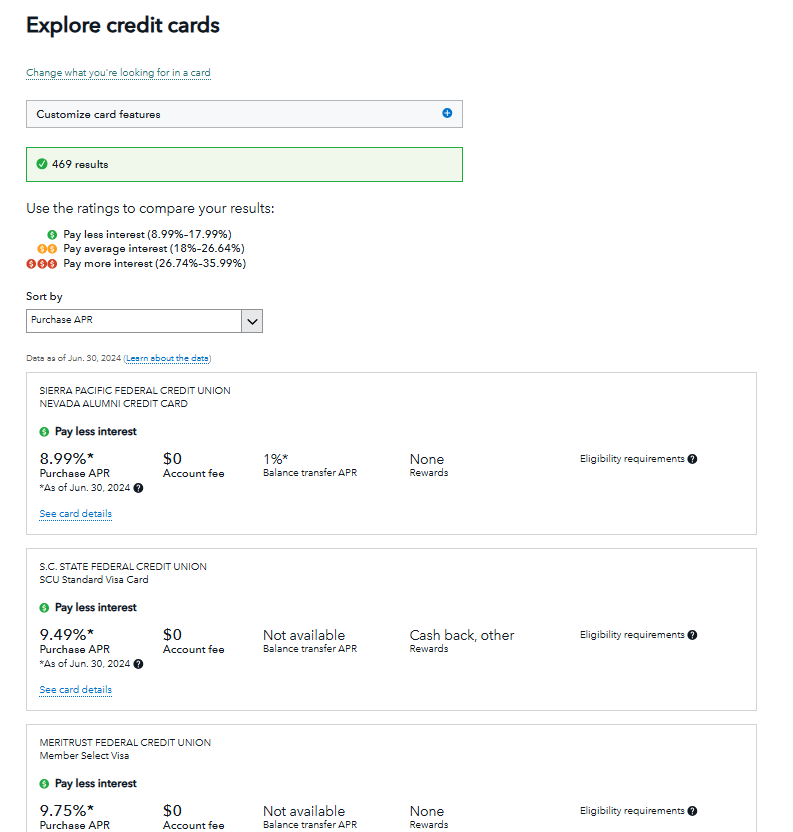

Upon making your selections, you’ll be presented with a list of credit card recommendations:

EXPAND

If needed, you can change your selections or refine your results through additional filters:

EXPAND

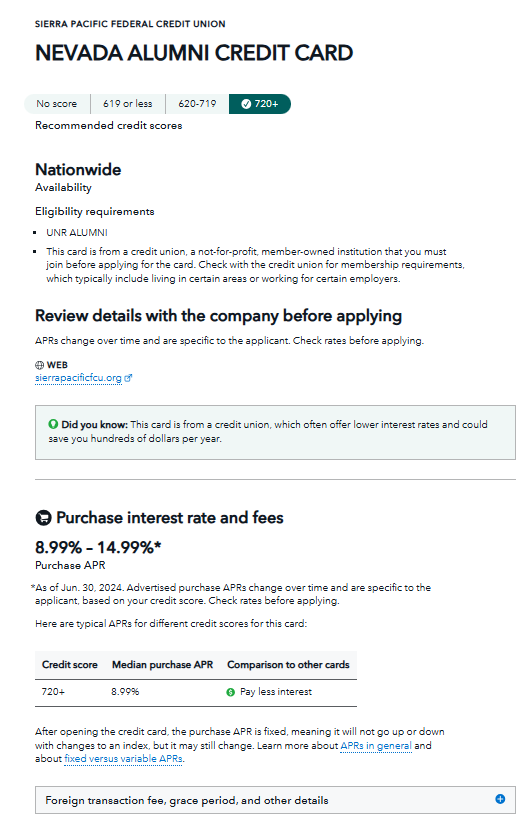

You can also click into each card listing to view more details:

EXPAND

Is Explore Credit Cards a win for consumers?

The CFPB’s goal of protecting consumers and increasing choice in the marketplace is admirable — providing transparent, unbiased data that empowers people in their financial decision-making is always a worthy pursuit.

However, after some initial testing of the tool’s first iteration by various members of our Bankrate credit cards editorial team, it’s not clear the current functionality of Explore Credit Cards is ready to fulfill these lofty ambitions.

The tool’s card recommendations are difficult to navigate and lack specificity

My initial search using the criteria pictured above produced 469 results; adding more filters still left me with 101 different options to evaluate.

Bankrate lead credit cards writer Benét Wilson had a similar experience. “When I tried it out, it spat out 230 cards that would fit for me,” she says. “I do this for a living, and I certainly am not going to look at 230 credit cards. If I won’t do it, it’s highly unlikely that those looking for a new card will either.”

Eligibility for recommended cards or stated benefits is not clear

I’m not eligible for the first result returned in my search — the Sierra Pacific Federal Credit Union’s Nevada Alumni Credit Card* — and there’s no apparent way the tool’s filters could have been configured to exclude it.

But beyond basic eligibility, it’s difficult to determine whether individual consumers will qualify for the rates and terms displayed. Not only is the data nearly six months out of date, confirming key details with many of the listed issuers is not easy.

“It’s difficult to find full card terms for a lot of the credit union options,” notes Bankrate senior editor Brooklyn Lowery. “Even if the CFPB is telling me the rate was 9.99 percent as of their last update, I often have to log in to or be a member of the credit union to actually see the most recent credit card terms and conditions.”

The tool lacks context on reward program quality

Rewards cards are popular with consumers. Bankrate’s 2024 Credit Card Rewards survey found that 80 percent of respondents earning $80,000 annually or more have at least one reward card (as do 44 percent of those who earn less than $40,000 annually and 63 percent who earn between $40,000 and $79,999). Consumers consider cash back to be the best feature of their rewards cards by a large margin, with travel rewards and widespread usability tied for second.

Unfortunately, while Explore Credit Cards does allow you to filter for cards that earn rewards (as well as specify the type of rewards you’re looking for), the tool provides no context on the quality of individual rewards programs that would allow consumers to compare them in a meaningful way.

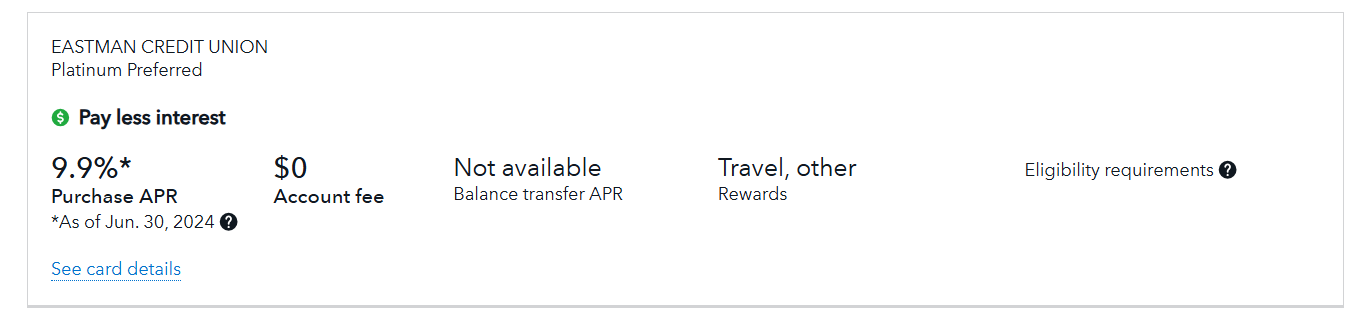

Filtering my search to travel rewards puts Eastman Credit Union’s Platinum Preferred Visa* in the top spot of my results. Digging into their website reveals that I’ll earn at least 1 point for every $1 spent on everyday transactions. Although it says I can redeem these points for airline tickets, hotel accommodations, car rentals, cruises, vacation packages, and destination activities and excursions, I can’t see the redemption rates for these options until I’m a cardholder. There’s no way for me to compare their value to the Chase Ultimate Rewards and American Express Membership Rewards I already earn to see if its rewards program makes sense for me and the way I travel.

EXPAND

Bankrate writer and rewards specialist Ryan Flanigan agrees. “This tool is a great idea, but it’s poorly executed and not polished enough to be legitimately helpful,” he says. “I put in my info, location and rewards and got pages of unusable credit union cards with minimal reward offerings. It definitely needs more filters and sort preferences to be at all useful. Perhaps some people can find benefit, but right now it feels like, if everything is special, nothing is special.”

In fairness, Bankrate senior editor Nouri Zarrugh calls out that, “This is from the Consumer Financial Protection Bureau, not the Consumer Financial Points & Miles Bureau, so it makes sense they emphasize APRs.” It’s a valid point, but it’s also worth noting that, if earning value from your rewards cards is a priority for you, Explore Credit Cards is unlikely to improve your current card research process.

Explore Credit Cards: What’s next and what you should know

There are certainly some groups of consumers who will find value in the current iteration of the tool, including those who are:

- Looking for the absolute lowest interest rates possible

- Interested in exploring credit cards from lesser-known, regional and niche issuers

- Willing to put in the leg work to evaluate multiple offerings

Ultimately, though, while the tool shows promise — and while the intentions behind it are good — it needs additional refinement to truly help consumers choose the best credit card for their specific financial circumstances. The CFPB anticipates the next update to the tool being released in spring 2025; it’s worth watching and waiting to see if any of these issues will be addressed in that process.

In the meantime, our advice for readers and aspiring credit card masters remains the same as always. However you choose your next card, take your regular spending habits, as well as how particular cards could align with them, into account. Then, make sure you have a plan to pay your bill in full and on time — even if your goal is to maximize rewards, no rewards rate can compete with the high cost of credit card interest charges on debt that rolls over from one month to the next.

*The information about the Nevada Alumni Credit Card and Platinum Preferred Visa has been collected independently by Bankrate. The card details have not been reviewed or approved by the issuer.

Read the full article here