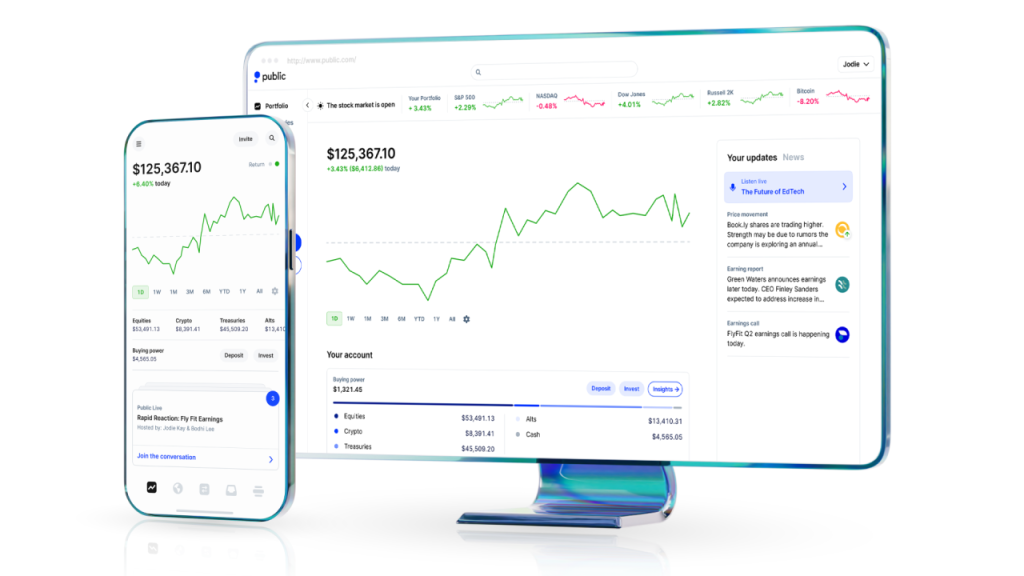

Public is an investing platform that offers a solid trading experience, free trades on stocks and ETFs, easy access to bonds — and options traders will enjoy getting money back on their trades through Public’s rebate program.

Other key features include:

- Fractional shares, so you can trade with as little as $1 with Public’s Investment Plan feature.

- Cryptocurrency trading, though there is a transaction fee charged by their crypto partner.

- Direct indexing, letting you mimic an index but with more flexibility than buying an ETF.

While Public offers most of what will interest a typical investor, you won’t find mutual funds on the app. And investors who want to be able to call a customer service rep, rather than just email or chat, might want to consider traditional brokers such as Fidelity Investments or Charles Schwab.

Overview of Public

| Category | Public |

|---|---|

| Minimum amount to open account | $20 |

| Tradable securities | Stocks, ETFs, options, cryptocurrency, bonds |

| Cost per trade | $0 (non-Premium members pay $2.99 for OTC trades and after-hours trades) |

| Customer service | Email and chat |

| Account types | Brokerage accounts, margin accounts, Roth and traditional IRAs |

| Account fees | Incoming transfers are free Outgoing ACH: $0 Outgoing ACAT: $100 Outgoing wire (domestic): $25 Inactivity fee of $3.99 each month an account with less than $70 is inactive for at least six months |

| Bond account maintenance fee | $0 (non-Premium members pay $3.99/month) |

| Premium subscription | $10/month or $96/year (free with $50,000+ balance) |

| Mobile app | The Public mobile app is available on the Apple App Store and Google Play Store |

| See Public’s fee schedule for more information. |

Best for:

- Options traders

- Investing with fractional shares

- Bond investors

Pros: Where Public stands out

Easy portfolio builder tool

With their Investment Plan option, Public makes it easy to invest in a pre-made portfolio aligned with your goals. You can easily invest in stocks organized around a theme — such as AI companies or green power — or you can choose a portfolio attuned with your risk tolerance, or one that’s focused on, say, bonds or dividend-paying stocks.

Want to set your trading on autopilot? Public lets you set up your Investment Plan to buy stocks or ETFs regularly, without you having to remember to send money to your portfolio. Premium members receive this feature at no extra cost, though non-Premium members will pay $0.49, $0.99 or $1.99 per recurring purchase, depending on the number of stocks and ETFs in their investment plan (1 to 3, 4 to 10 or 11 to 20, respectively).

Direct indexing

Public also offers direct indexing, which lets you invest directly in the companies that comprise an index. You’ll need to invest $1,000 to get started, but once you do you’ll have more flexibility to structure your portfolio exactly how you want it — and to take advantage of tax-loss harvesting.

Options pricing

Not only does Public give you access to $0 options, it offers revenue sharing on options trades. That means clients can receive 50% of the broker’s revenue on trades, though you’ll need to sign up for the program. The net effect means that (incredibly) you may wind up being paid for your options trades.

For example, Public estimates that clients would receive about $0.18 per contract traded and a net $0.15 per contract, after factoring in regulatory fees, which are assessed at every broker. This pricing structure may well make Public the best options broker out there, among brokers offering free options trades.

Bond trading

Public began offering Treasury securities and corporate bonds in 2023, giving it a presence in the fixed-income world. Trading individual bonds is typically the province of more sophisticated investors, in part because it costs around $1,000 to buy a single bond, making it prohibitive for many individual investors. Public is changing that, and allowing investors to buy a much more manageable portion of a bond in the $100 range, opening up the market to more people.

Public charges a fee of $0.10 to $0.25 for every $100 face value in Treasury bonds, while corporate bonds run $0.35 to $0.50 for every $100 in face value. If you’re a Premium member, there’s no monthly maintenance fee for a bond account but non-Premium members will pay $3.99 a month.

For investors looking to further diversify their bond holdings, Public offers a Bond Account that requires an initial $1,000 minimum deposit, allowing you to invest in a portfolio of 10 corporate bonds that lock in a set yield at the time of purchase. Note that the bonds offered are of medium credit quality, which means there is an elevated level of default risk associated with them compared to higher-rated options. You’l need to assess whether these bonds suit your risk tolerance.

Fractional shares

Public allows fractional shares on its platform, which means you can buy a slice of even the highest-priced stocks or ETFs. And with the low trade minimum of just $1 with the Investment Plan feature, you can own a piece — albeit a tiny one — of anything. This feature gets every last dollar of your money working for you, regardless of the stock price.

Not only does Public support buying partial shares, but it also allows you to reinvest in them, too. So when you receive a dividend, you can set the app to reinvest it into the stock that paid it.

Not many brokers offer both features. In fact, Fidelity, Charles Schwab and Robinhood are some of the only major online brokers that offer both.

Public Premium subscription

Public Premium, a subscription service that costs $96 a year, or $10 per month if billed monthly, gets you more financial metrics to analyze investments. You’ll also avoid some of the fees that non-Premium members face, including the ability to set up an automatic investment plan at no extra cost.

There’s a way to skip the fee: Simply have an account with $50,000 and Public will give you access to Premium gratis.

Access to cryptocurrency

In addition to stocks and ETFs, cryptocurrency is also available on Public. The app offers more than 40 of the most popular coins, including bitcoin and ethereum. Plus, you can invest as little as $1. Public’s partner Zerohash charges 1.25% of the transaction value above $500 and a sliding scale below that (for example, $0.49 for a trade worth up to $10, or $0.69 for a trade worth between $10 and $25).

Cons: Where Public could improve

Lack of mutual funds

If you want to invest in stocks and ETFs, you’ll find what you’re looking for here. Throw in the high-risk, high-return potential of options, and this selection will suffice for many investors, maybe even most.

But investors looking for mutual funds will have to set up an account elsewhere.

Customer service

For some investors, access to email and chat may suffice. And we will note that when we emailed customer service during regular business hours, we received a helpful reply within an hour. But there may be times when you really need to speak to a customer service representative. As of this writing, Public doesn’t offer telephone support.

—Logan Jacoby contributed to this story.

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Thank you for your

feedback!

Your input helps us improve our

content and services.

Read the full article here