Key Takeaways

- During the holiday shopping season, we’re presented with countless spaving deals, which require you to spend more in order to qualify for a discount, free items or free shipping.

- It’s important to evaluate these deals on a case-by-case basis, and make sure you’re not spending more than you planned (or you’re comfortable with) just to qualify for the deal.

- A big part of smart holiday spending includes determining how much you’re able to spend, creating a corresponding budget and sticking to it.

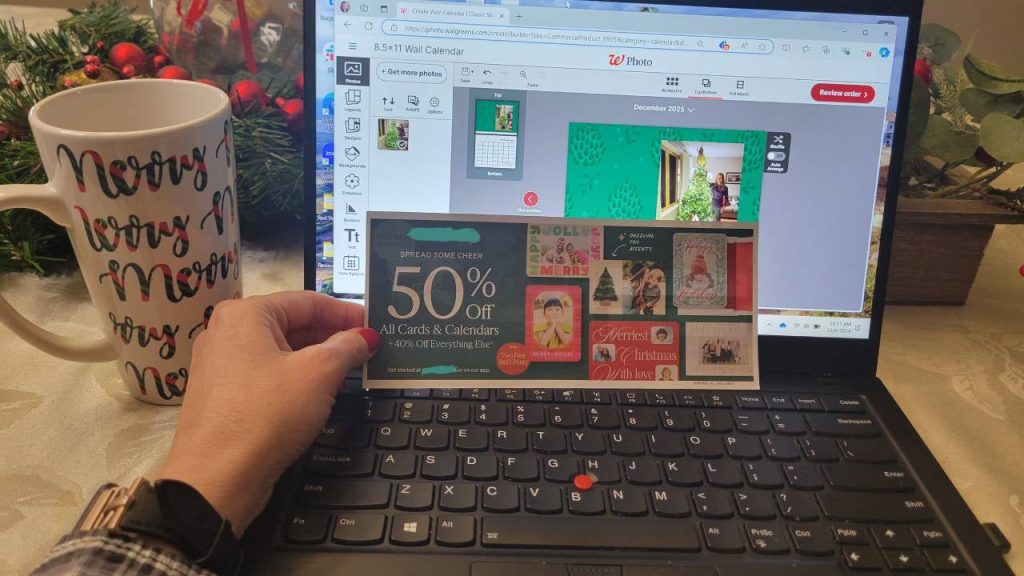

When doing some recent Christmas shopping, I decided to make a custom 2025 photo calendar for a family member. I logged onto my go-to website for ordering photo gifts, and then decided to see if any deals were being offered. I was excited to find a promotion, only to realize it required that you buy two calendars to get two more for free. After some brief reflection, I decided I didn’t want to spend the money and effort to create four calendars — three of which I didn’t really need — so I abandoned my order and found a better offer elsewhere for 50 percent off a single calendar.

The buy-two-get-two calendar promotion is a great example of a spaving deal. The term spaving is a combination of “spending” and “saving,” and it applies to deals that require you to spend a bit more to qualify for free items, discounts or free shipping. We’ve talked about spaving before, and now that it’s the holiday season, stores are offering more of these deals than you can shake a stick at, as my grandmother would have said. Here are some of the many examples I found online:

- Buy two pairs of shoes and get a third at 50 percent off

- Save $25 when you spend at least $100 in baby care items

- Save 35 percent on makeup orders of $75 or more (plus get a free moisturizer)

- Purchase one magazine subscription and get another at half off

- Buy 3 dozen golf balls and get 1 dozen more free

When it comes to winter holiday spending, an interesting fact I came across is that consumer spending is expected to reach an average of $902 per person this year for gifts, food, decorations and other seasonal items, according to the National Retail Federation. Whether your own shopping list is long or short, why not make the wise decision to avoid overspending just to get a “deal”? In reigning in your spending, you’ll thank yourself come January when there’s not a massive credit card bill keeping you up at night.

When done right, spaving and other money-saving deals can be a big win for your finances. It all depends on your own unique needs and your budget. Here are some useful tips to help you save money as you shop for holiday gifts — including some insight on the right ways to spave.

1. Create a holiday budget.

All the deals and promotions in the world won’t do you much good if you don’t come to terms with how much you can afford to spend — and stick to your limit. As such, it’s not too late to create a plan for what you still need to buy, and how much you’re willing and able to devote to each item. Start by determining how much money you have to work with, and go from there. And just because it’s the holiday season, that doesn’t mean you should forego prioritizing your savings goals, such as saving for an emergency fund and retirement. Items you may wish to budget for include:

- Gifts: Decide who you wish to buy gifts for and how much to spend (more on establishing spending limits with family and friends below).

- Parties: If you’re hosting any holiday get-togethers, be sure to account for those in your budget, including the costs of food and drinks. Attending a party can also come with a cost if you’re bringing a gift or making a dish to share.

- Decorations: If your budget is stretched, this may be one area to cut back or eliminate — especially if you’ve accumulated plenty of decorations from past years. Be sure to go through what you have before buying more. (Keep in mind, if you are willing to wait until next season, you’ll find decorations at a fraction of the cost once the holiday is over.)

- A present for yourself: If there’s any money left over in your budget, consider treating yourself to something nice by taking advantage of any deals you come across for a spa or restaurant meal.

2. Consider items you’d be buying anyway.

When done right, spaving can actually save you a bundle on things you truly want and need. Last week, for instance, a local shoe store offered a buy-two-get-one-free deal. I was able to buy both of my kids a pair of shoes for Christmas, while also picking up (for free) a pair I’d already planned to buy for myself. If the circumstances were different, and I didn’t need to buy two pairs of shoes to begin with, it probably would have been best to turn down this deal.

At this time of year, it’s common for big box stores or other retailers to offer spaving deals that allow you to save a set dollar amount if you spend a minimum amount. For instance, I’ve seen my local big box store offer Santa Bucks for $25 off a purchase of $100 or more. If the terms of such a deal allow, consider buying a combination of gifts and items you need for your household, if that helps you qualify for the savings.

3. Look for spaving deals on gift cards.

It can be worth your while to look for spaving deals when purchasing gift cards for family and friends. You can also purchase gift cards for yourself from stores and restaurants you regularly shop at. In perusing the websites of Rakuten and giftcards.com, I was able to find deals such as:

- Buy a $100 gift card and receive a free $10 gift card

- Buy a gift card and get a percentage of what you spent toward a future gift card purchase

Another way you can earn free gift cards is to use a rewards program, such as Capital One Shopping or Chase Ultimate Rewards, when you make purchases throughout the year. Such programs often allow you to redeem your accumulated points for gift cards, among other rewards. This can come in handy when you’re looking for gift cards for holiday presents or simply to save on a planned purchase for yourself, such as for dining, clothing, housewares, sporting events or travel.

If a deal allows you to earn a bonus gift card for yourself, be sure not to lose track of these gift cards, read the fine print and use them before they expire or accrue inactivity fees. Bankrate found that 43 percent of U.S. adults have at least one unused gift card, and that the average amount in unused gift cards, gift vouchers or store credit is $244 per person, according to Bankrate’s 2024 Gift Card Survey.

4. Establish spending limits with friends and family.

It can’t hurt to establish limits on your gift spending — and to make sure friends and family members are on the same page. Case in point: After many years of buying more than a dozen gifts for various cousins, aunts and uncles, a friend of mine recently proposed her family switch to a grab bag (a.k.a. Secret Santa) system. As nervous as she felt about suggesting this, everyone wholeheartedly agreed and breathed a collective sign of relief at the thought of only needing to bring a single present to the party.

In fact, a desire to spend less on holiday gifts is common enough this year, with 33 percent of holiday shoppers reporting they planned to spend less in 2024 than in 2023, Bankrate’s 2024 Holiday Shopping Survey found.

5. Start saving now for next year’s holidays.

As important as it may be to avoid overspending just to qualify for a deal, the most useful advice around may actually be to start saving for next year’s holiday shopping now. By setting aside some money every single paycheck, you can accumulate a nice nest egg by next fall.

To get started, consider setting up a separate high-yield savings account, which will earn more money than a traditional savings account. You can also opt for a savings account that lets you categorize portions of your money toward different goals. For instance, my account allows for savings buckets, so I’m able to devote one to Christmas shopping. What’s more, I can easily transfer money there from my checking account.

“The easiest way to utilize your high-yield savings account for next year’s holiday spending is to set up a direct deposit from your paycheck into an account, or sub-account, designated for that purpose,” says Greg McBride, CFA, Bankrate chief financial analyst. “Another option is to have an automatic bank transfer from your checking account into this dedicated savings account on a regular basis over the next 12 months.”

Ultimately, the best gift to give yourself next year just might be the joy of a holiday season that doesn’t come with the stress of coming up with ways to pay for it all.

Bottom line

I referenced my grandmother toward the start of this article; one other thing she used to say was that in life, your loved ones are the most important aspect, followed by learning, followed by money and material possessions. When I think about this, I worry less about what gifts, and how many, I’m buying for my loved ones. It’s a pretty safe bet our family and friends wouldn’t want us overspending just to provide them with holiday presents.

Sage advice notwithstanding, it’s very easy to get caught up in qualifying for spaving deals — and other promotions with strings attached — only to realize later that it truly wasn’t worth your while. The best way to steer clear is to have a spending plan and really think closely about a deal before clicking “buy now” or pulling out your wallet.

Happy Holidays!

Read the full article here