Key takeaways

- A mortgage loan estimate is a standard three-page document detailing the estimated costs, structure and other terms of a loan.

- Mortgage lenders are required by law to provide borrowers with a loan estimate within three business days of receiving the loan application.

- The loan estimate helps borrowers understand the complete cost of their mortgage and makes it easier to compare loan offers.

What is a mortgage loan estimate?

A mortgage loan estimate is a standardized, three-page document from a lender containing details about a mortgage, including its type and terms, as well as its projected costs. The information in the document isn’t final, but it lets borrowers compare offers and budget appropriately.

Why compare mortgage loan estimates?

When will I get the mortgage loan estimate?

Mortgage lenders are required by law to provide borrowers with a loan estimate within three business days of applying for a mortgage or refinance.

What is included in your mortgage loan estimate?

A mortgage loan estimate includes the following key details:

All lenders are required to use the same loan estimate document, a standard that was implemented by the Dodd-Frank Act of 2010.

How to read your mortgage loan estimate

You’ll receive a loan estimate whether you’re buying a home or refinancing. In either case, use the document as a guide for budgeting and comparing costs between lenders.

Here’s a loan estimate example broken down by page and section. You can view a similar, interactive visual on the Consumer Financial Protection Bureau’s website.

Loan estimate example: Page 1

EXPAND

Summary

Page one of the mortgage loan estimate includes a summary of your loan. In the first section, you’ll find the following information:

- Loan term: The number of years it will take you to pay off the mortgage

- Purpose: Whether the loan will purchase or refinance a home

- Product: Whether the mortgage has a fixed or adjustable interest rate

- Loan type: Whether the mortgage is a conventional loan or some other type, such as an FHA or VA loan

- Rate lock: If the lender has locked the interest rate and when that lock expires

Loan terms

The loan terms can be found in the second section, as well as information about whether some of them can change after closing:

- Loan amount: How much you’re borrowing

- Interest rate: The percentage you’ll pay in interest, and whether it’s fixed for the life of the loan or will adjust, and under what terms

- Monthly principal and interest: Your expected total monthly mortgage payment, excluding your homeowners insurance and property taxes

- Prepayment penalty: Stipulates if your lender charges a fee if you choose to pay off your mortgage before the original loan term ends

- Balloon payment: Stipulates if there is a large principal payment due when the loan term ends

Projected payments

In the third section, you’ll find a detailed breakdown of your projected monthly payments:

- Payment calculation: This shows the costs that make up your monthly mortgage payment, including principal and interest, and payments toward escrow and private mortgage insurance (PMI), if applicable.

- Estimated total monthly payment: This totals the components that go into your estimated regular mortgage payments.

- Estimated taxes, insurance and assessments: An estimate of how much your homeowners insurance and property taxes will cost, as well as if they’ll be held in escrow.

Costs at closing

In the fourth section, you’ll find information about the costs you’ll pay on closing day:

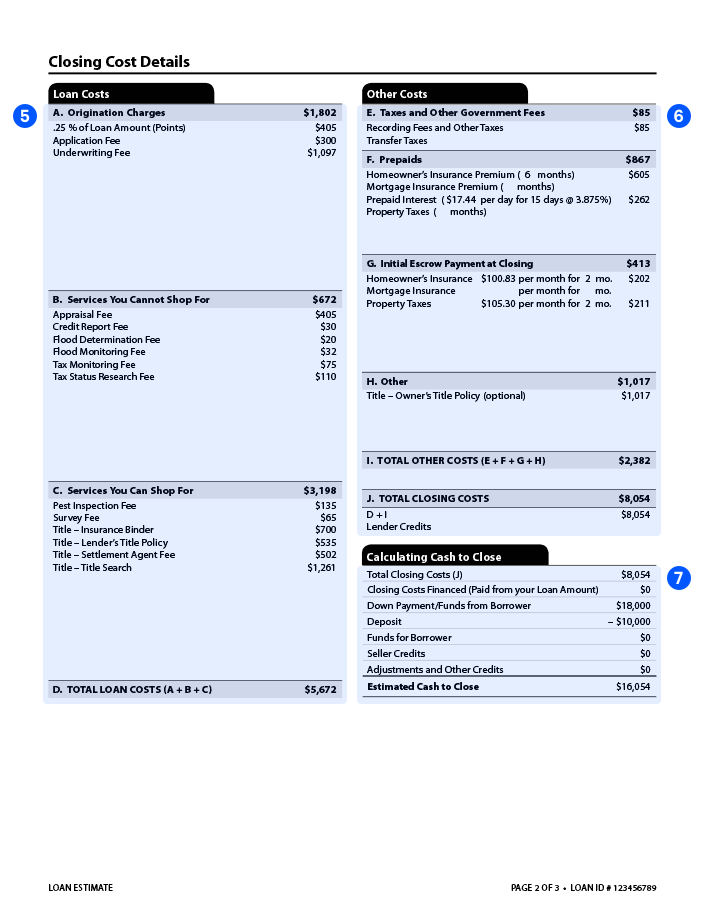

Loan estimate example: Page 2

EXPAND

Loan costs

This section offers a detailed list of services related to the creation of your loan and how much you’ll pay for each.

- A: Origination charges: Most lenders charge a fee for initiating the mortgage, which can include fees for the application and other services, plus any mortgage points you’re buying to lower your interest rate.

- B: Services you cannot shop for: This details a series of services you must pay for as quoted to close the mortgage, such as an appraisal and a credit check.

- C: Services you can shop for: You must also pay for these services, such as a property survey and title search, but you can compare providers and potentially lower your costs.

- D: Total loan costs: This is the sum of parts A, B and C.

Other costs

The sixth section details the rest of the fees that make up your total closing cost. These include:

- E: Taxes and other government fees: This includes fees for recording the mortgage with the city or county, as well as property transfer taxes, if applicable.

- F: Prepaids: This section explains the amount of your homeowners insurance premiums, mortgage insurance premiums, interest and property taxes that you’ll pay at closing.

- G: Initial escrow payment at closing: You have to pay upfront for the items that will go in escrow, including your initial homeowners insurance premiums and your first property tax installment.

- H: Other: This includes additional, sometimes optional, costs, such as an owner’s title insurance policy.

- I: Total other costs: The sum of parts E, F, G and H.

- J: Total closing costs: The sum of parts D and I.

Calculating cash to close

The final section on the second page of the loan estimate, “Calculating cash to close,” sets out each cost you’ll have to pay at the closing, including the down payment and total closing costs calculated in part J of the estimate document. This is the full estimated amount of cash you’re required to have on hand when you close on your mortgage.

Loan estimate example: Page 3

EXPAND

Comparisons

The final page of the loan estimate lists more important details of your mortgage agreement, like the names of the lender and the loan officer. The eighth section also lists three key figures you can use when comparing loan offers:

- Amount of the loan principal you will have paid off after the first five years of your mortgage term, as well as the combined principal, interest and mortgage insurance costs, if applicable

- The loan’s annual percentage rate, or APR, which is the total cost of your loan expressed as a rate. Because this includes closing costs, among other charges, it will be higher than your interest rate.

- Total interest percentage, or TIP, which is the amount of interest you’ll pay over the term of the loan, calculated as a percentage.

Other considerations

The final page also explains other parts of the mortgage payment process and your responsibilities as the borrower. This spells out, for instance, your appraisal and homeowners insurance requirements, whether or not the loan can be assumed, any late payment penalties and whether the loan will be serviced by the lender or sold to a separate entity that will service it.

Even after you accept a mortgage offer, hang onto the loan estimate. It’s important to compare the information on it with the figures you receive in your closing disclosure, a breakdown of final expenses and costs you’ll receive at least three business days before the mortgage closing.

How to compare mortgage loan estimates

When comparing offers between mortgage lenders, follow these tips:

- Pay attention to where the estimates differ on interest rate, origination charges and points. This will ensure you’re comparing apples to apples — for example, that you’re comparing each lender’s rate with an equal amount of points. It’ll also help you determine if a lender with a lower rate also charges higher fees or vice versa.

- Compare the bottom line of the estimated monthly payment and the estimated cash to close.

- Focus on the costs in parts A, B and C, which list origination charges and fees for the services for which you can’t and can shop around. Even if you’re allowed to find an alternate provider, keep in mind that your lender might have a partnership that includes a preferential rate.

- Note any third-party fees that appear in one lender’s loan estimate and not another’s.

- Look for any lender credits you were promised verbally. If they don’t appear on the loan estimate, ask your loan officer for clarification.

- If you’re refinancing, keep an eye out for any differences in the loan amount between lenders. If you’re obtaining a no-closing cost refinance, make sure you understand how those closing costs are accounted for.

FAQ

-

The Consumer Financial Protection Bureau (CFPB) recommends comparing at least three lenders. Comparing multiple lenders will help you find the best lender for your needs and the lowest interest rate.

-

The seven-day rule for loan estimates requires lenders to provide the original loan estimate to the borrower at least seven business days before the loan’s closing date. It’s part of the TILA-RESPA Integrated Disclosure (TRID) rule.

-

Comparing loan offers does affect your credit score, but only slightly. When you apply for multiple loans within a short period of time, it only counts as one hard credit inquiry. Your credit score should rebound quickly if you continue to pay your bills on time.

Read the full article here