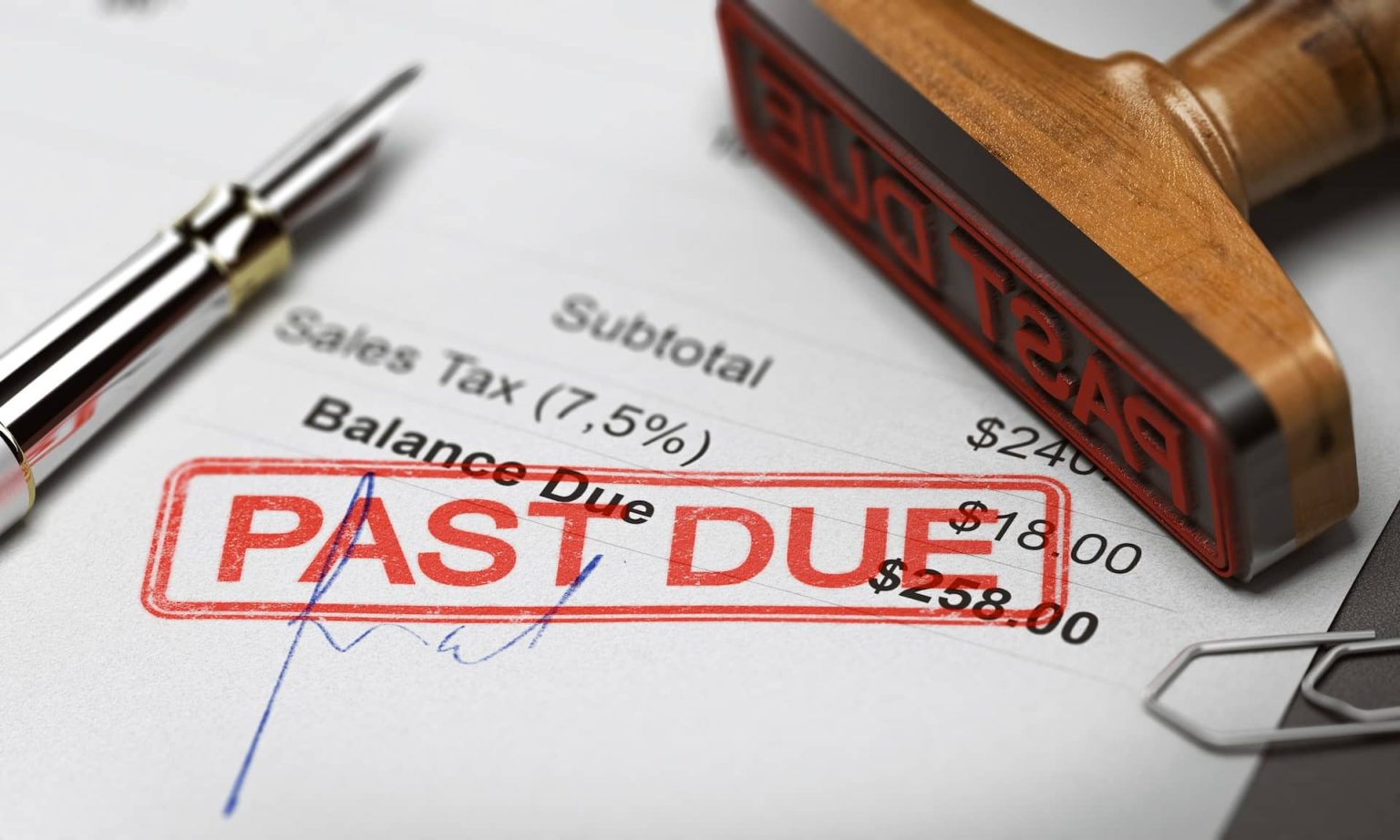

Credit Sesame discusses the rise in missed debt payments and growing concerns about credit access and financial stability.

A recent survey found a big jump in the probability that consumers will miss a minimum debt payment over the next three months.

If that happens, it could disrupt the economy, tighten credit availability, and significantly impact credit scores. Beyond these big-picture effects, missed payments can create a financial crisis for any household. Rather than wait for trouble to escalate, it is better to take action before it gets out of control.

Missed debt payment risk highest since April 2020

The Federal Reserve Bank of New York’s February Survey of Consumer Expectations found that the perceived probability of missing a minimum debt payment in the next three months rose sharply to 14.6%.

That’s significant for a couple of reasons. First, the concern about missing payments has been the highest since April 2020. That’s when pandemic shutdowns were setting in, and millions of workers were sidelined.

Thankfully, there’s no pandemic to deal with today. Even so, it says something about how bad the debt situation is when consumers think their chances of keeping up with their payments are as bad as when much of the economy was shutting down.

Secondly, 14.6% of consumers expecting to miss a debt payment is a sharp increase from the 4.14% of consumers who fell behind on payments in the fourth quarter of 2024, according to the New York Fed’s Quarterly Report on Household Debt and Credit. Such a large spike in payment delinquencies would likely have serious consequences.

Consequences of missing debt payments

First, consider the big-picture consequences. When many consumers miss debt payments, lenders tighten lending standards. The Survey of Consumer Finances shows credit availability expectations are already declining rapidly.

Without access to credit, many households would lose the financial flexibility they need to make ends meet. That can cause problems to spiral. Late payments would add to an already unmanageable debt burden. Those missed payments could also cause credit scores to plummet. As a result, access to credit would become further restricted. Lower credit scores would also mean that what credit consumers could obtain may become more expensive.

Credit card debt has already taken on a life of its own

Already, there is evidence of the spiraling effect of debt problems. A recent report on major credit card issuers found that the total credit card debt owed is growing faster than credit card spending.

That suggests credit card payments are generally insufficient to keep up with the combination of spending, interest charges and fees. That means the snowball is growing and heading downhill.

Strategies for avoiding missed payments

If you’re among the growing number of consumers who see missing payments as a distinct possibility, it’s time to take action before your debt problem gets out of hand. Here are some steps to consider:

Stop the bleeding

Ultimately, you’ll have to work on paying down the debt you already have, but the place to start is by preventing that debt from getting any bigger. Immediately cutting excess spending is essential, even if it means taking the credit cards out of your pocket for a while.

Create an emergency budget

Look at every item in your budget to distinguish between what is essential and what can be cut. Even with some basic items like food, there may be room to cut back or switch to cheaper alternatives.

An emergency budget isn’t fun, but it’s temporary. As you pay down debt, you’ll regain financial flexibility.

Look for a side hustle

Adding a little extra income can be a game-changer when it comes to defeating debt. Of course, working an extra job can also be exhausting, but as with your emergency budget, you can look at it as a temporary measure.

Taking on extra work for a while can get you off the debt treadmill sooner. That way, when you return to your regular work schedule, you can enjoy your free time more.

Ask creditors for flexibility

If you cannot figure out how to pay a bill, do not hide from the problem. Figure out how much you can pay now and when you can to make up the shortfall. Then contact the creditor to see if they’ll cut you some slack.

Providing more time, lowering minimum payments, or waiving late fees are some of the ways creditors may help customers who are having financial problems. However, they’ll only do this if you approach them first. You’ll be more likely to get a sympathetic response if you explain why your finances have gotten out of whack and show you’re sincere about eventually paying what you owe.

Refinance high-cost debt

If you have a lot of credit card debt, high interest rates probably add a lot to your debt problem. Find ways to refinance with lower-interest debt, such as a personal loan or a balance transfer credit card. Ideally, do this before missed payments pile up, potentially ruining your credit history and score. Ruined credit can take time to rebuild and may stop you from getting a loan or credit card in the future.

Debt problems tend to creep up on people gradually, but eventually, they reach a tipping point where they get out of control. The best approach is to take action before that point is reached. Addressing missed debt payments sooner rather than later can help protect your credit and financial future.

If you enjoyed Missed debt payments are on the rise—what it means for your credit you may like,

Disclaimer: The article and information provided here are for informational purposes only and are not intended as a substitute for professional advice.

Read the full article here