UnitedHealth Group shares fell more than 15% in early morning trading on Thursday, after The Wall Street Journal reported that the U.S. Department of Justice was investigating the company for potential Medicare fraud.

The latest news adds to the health insurer’s litany of woes, including multiple government inquiries, a sudden change in top leadership and a pulled outlook in the face of soaring medical costs.

Investors and analysts noted that while details on the investigation were limited, they did heighten investor concerns.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| UNH | UNITEDHEALTH GROUP INC. | 256.80 | -51.16 | -16.61% |

UNITEDHEALTHCARE ANNOUNCES NEW CEO AFTER KILLING OF BRIAN THOMPSON

“The stock is already in the doghouse with investors, and additional uncertainty will only pile on,” said James Harlow, senior vice president at Novare Capital Management, which owns shares in UnitedHealth.

The company, however, said that it had not been notified by the DOJ regarding this criminal investigation.

The news of the probe follows CEO Andrew Witty’s abrupt departure and the withdrawal of its 2025 forecast, which triggered an 18% drop in shares to a four-year low on Tuesday.

“UnitedHealth Group is mired in a crisis seemingly without end. Investors are bracing for another big bout of turbulence given reports of the DOJ investigation,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

UNITEDHEALTH GROUP AIMS TO GET BACK TO BUSINESS AFTER CEO MURDER

If premarket losses hold, UnitedHealth’s market capitalization will touch $280 billion, or almost half of the $530 billion recorded on April 16, a day before a surprise earnings miss sparked a selloff in its shares.

The health insurance industry has come under government scrutiny after a lawsuit this month accused three major U.S. insurers of paying kickbacks to brokers to steer patients into their plans.

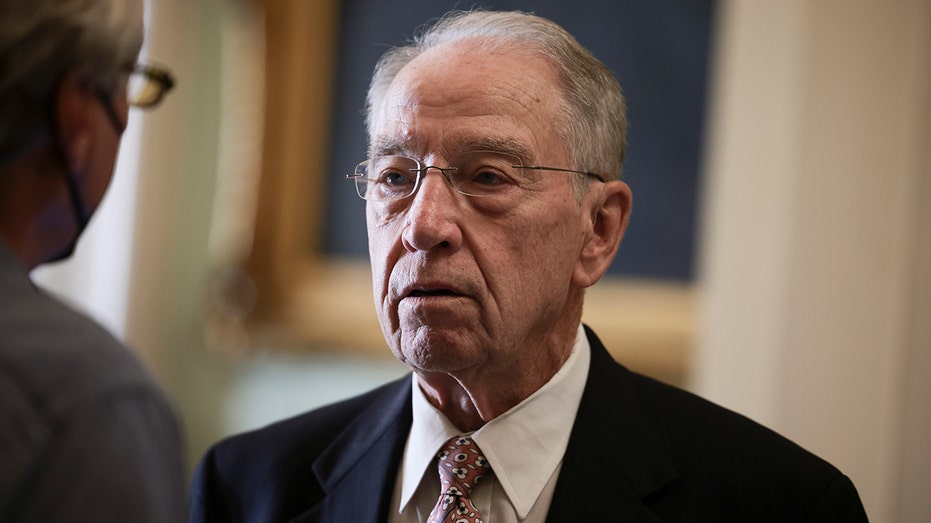

In February, the WSJ revealed a civil fraud investigation into UnitedHealth’s Medicare practices, while U.S. Senator Chuck Grassley launched an inquiry into the company’s billing methods, demanding detailed compliance records.

For decades, the company has flourished by leveraging its dominance in insurance and growth in the Medicare market, the U.S. government program that covers medical costs for the elderly.

This streak of strong performance came under pressure just months after a senior executive was tragically killed, allegedly by a man enraged over insurer practices.

Read the full article here