Bloomberg / Contributor / Getty Images

Prediction markets are a fascinating way to harness expert knowledge, helping publicize insight that might otherwise remain private. These markets give experts a financial incentive to make their information public or even for non-experts to bet on specific outcomes, such as an election or the price of a stock index or cryptocurrency. But they’re not without drawbacks, as prediction markets may often look like gambling and be subject to forms of market exploitation.

Here’s why prediction markets are soaring in popularity and why investors need to be careful.

How do prediction markets work?

A range of prediction markets has sprung up in recent years, as hot money, real experts and gamblers race to where the action is. Prediction markets use what are known as event contracts to create a market for real-world events, such as elections, sporting contests, and the price of stock indexes and cryptocurrencies at specific points in time, among many others. Thousands of contracts can be going at once, which offers plenty of action for die-hard gamblers.

Event contracts are structured as yes/no bets — one side is right and gets the payout while the other is wrong and loses. So the event contracts need to be set up in such a way that there is no middle ground. Event contracts are a kind of binary option, in which only one side is correct. At the end of the event, the wager contract is settled among the counterparties.

For example, a prediction market might have a proposition such as the following:

Will the price of Bitcoin be above $110,000 on Aug. 25 at 12 p.m. ET?

- Buy Yes: 14 cents

- Buy No: 89 cents

If you think the price of Bitcoin will be above this price by this time, you can buy a yes share for 14 cents, up to as many shares as you like. If you think Bitcoin won’t reach the target price, you can buy the no share for 89 cents. In either case, if you’re correct, you are paid out $1.

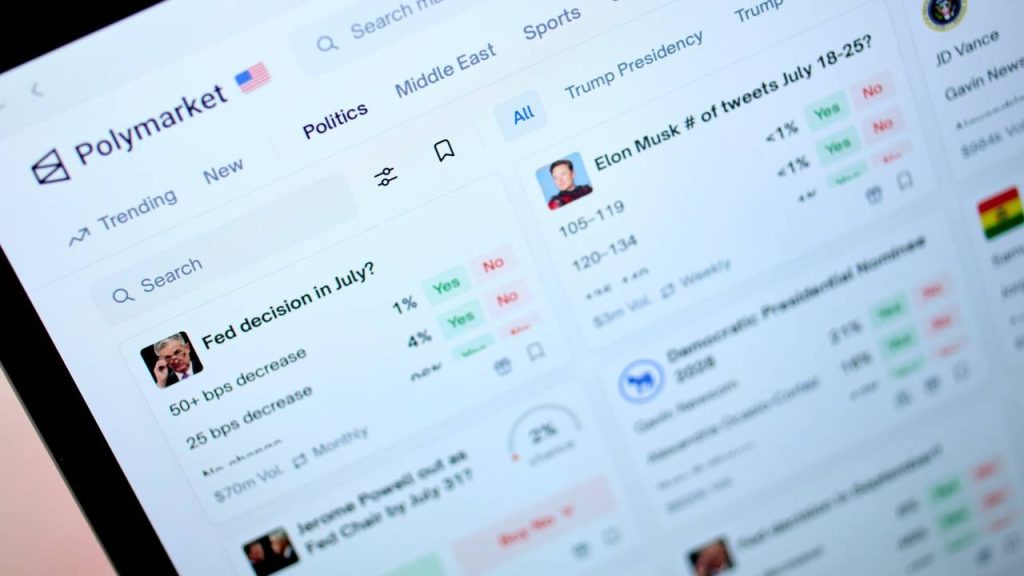

Some of the bigger names in the prediction market include Polymarket, PredictIt and Kalshi. They offer bets on politics, sports, international politics, culture and a range of other things. Want to wager on how many tweets Elon Musk makes in a given week? You can do it there.

Brokers such as Robinhood and Interactive Brokers also offer event contracts, though the range of events are often more focused, such as on economic and financial events or sports.

Why prediction markets can be valuable

Prediction markets can be especially interesting as predictive tools and, in their best form, they can provide real social value by publicizing the likely outcome of events. Prediction markets give experts a financial incentive to express an informed opinion on the outcome of an event, so this knowledge can become public. For example, those with a detailed understanding of an election outcome or a geopolitical event can make a wager, expressing their opinion through a prediction market. Their knowledge becomes public, providing a broader understanding of the event.

Of course, many event contracts concern all but worthless information. For example, recent popular contracts included, “Will MrBeast raise $40M for clean water by August 31?” and “Is the Earth flat?” And of course, there’s always betting on how prolific Elon Musk’s tweet game is.

What are the pros and cons of prediction markets?

Prediction markets present a number of risks to investors, not only in the nature of the event contract but also in the market itself.

Advantages of prediction markets

- Publicize otherwise private information: Prediction markets can help surface hidden or expert information, which can provide valuable information to a wider audience.

- Potential to multiply your money: Event contracts can make a lot of money, especially if you have out-of-consensus information that turns out to be correct. The more out of consensus your correct information or opinion is, the more valuable it could be.

- Bite-sized shares: Event contracts may allow you to buy shares for between 1 cent to 99 cents, meaning you can take on as many contracts as you like without the cost of a single contract being a deterrent.

- New “hedgeable” risks: By surfacing new information and offering contracts, prediction markets can create ways for participants to hedge against those risks in other markets. For example, if you were concerned that a geopolitical event might affect the price of oil, on which some of your other investments depend, you might be able to use event contracts to hedge that risk.

Disadvantages of prediction markets

- Similarities to gambling: Many events contracts are simply gambling by another name, like binary options. In fact, sporting events are a popular subject for prediction markets. But even other financial contracts look similar, such as whether a stock or index reaches a specific level by the end of the day. Such contracts look much like zero-day options — with short-term, all-or-nothing payoffs and losses with no expertise needed. So there’s literally no investment here — it’s simply a more or less short-term wager on an event.

- Wagers on “unknowable” things: Many event contracts don’t require expertise and are just proposition bets on the outcome of something that is more or less meaningless — the number of Elon Musk’s weekly tweets being a great example. Participants can’t possibly know this kind of information — it’s just a guess.

- Markets are inefficient and being “gamed” by bots: Research suggests that prediction markets are not that efficient and are being gamed by bots that take advantage of inefficiencies. Research from IMDEA Markets on 86 million bets from April 2024 to April 2025 suggests that bots may exploit mispricing in different markets via arbitrage to gain risk-free profits. While the probabilities of yes-and-no outcomes should always total 100 percent, sometimes they don’t (as in the real-life example above), giving lightning-fast bots a chance to place a trade and profit from risk-free arbitrage.

- Outlawed in many countries: Because of its gambling-like nature, prediction markets may be outlawed in many places. For example, Polymarket is outlawed in quite a few countries, including France, Switzerland, Singapore and Thailand. It has been blocked in the United States since 2022, but its recent purchase of a derivatives exchange may allow it to return to the United States. That said, prediction market Kalshi is legal in all U.S. states.

- May use stablecoins: Prediction markets such as Kalshi and Polymarket use the USDC stablecoin. Stablecoins function much like the U.S. dollar but with more significant and potentially serious risks that are not solved by the recently passed GENIUS Act.

Bottom line

For investors, prediction markets look more like gambling than they do investing, and while some event contracts may provide valuable information, many are simply silly wagers about trivial data. So investors thinking about “investing” in prediction markets should carefully consider what benefits they’re deriving compared to actually investing in thriving, cash-flowing businesses.

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here